r&d tax credit calculator hmrc

The calculation of your RD tax relief benefit depends on the companys situation whether it falls into the category of-. Request form for PAYE CHAPS transfer.

Rdec Scheme R D Expenditure Credit Explained

RD Tax Credit Calculation Examples.

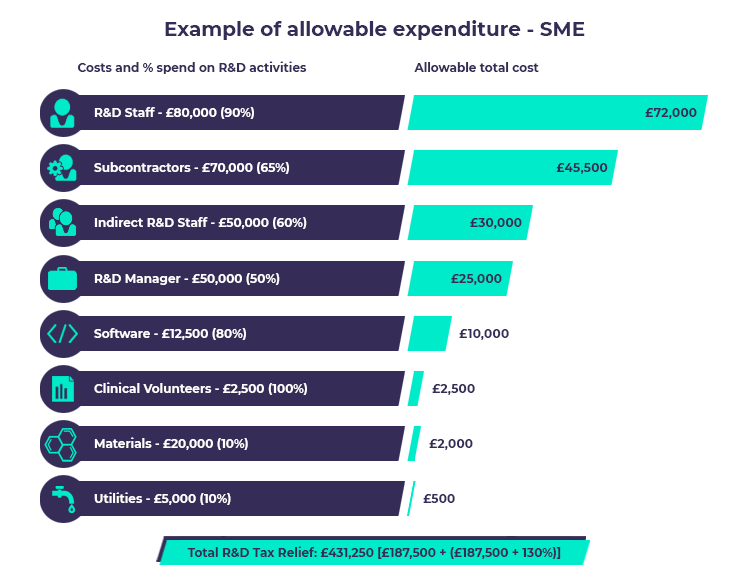

. This can be done for the current financial year and the 2 previous. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Reduce any relevant subcontractor or external staff provider payments to.

Calculate the company car tax charge based on a cars. According to the latest HMRC RD Tax Credit Statistics the average SME claim in the year ending March 2020 was 57723. Our RD tax credit calculator.

A claim for an RD Tax Credit or payable RDEC should be made as soon as possible after the end of. Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC. It was increased to.

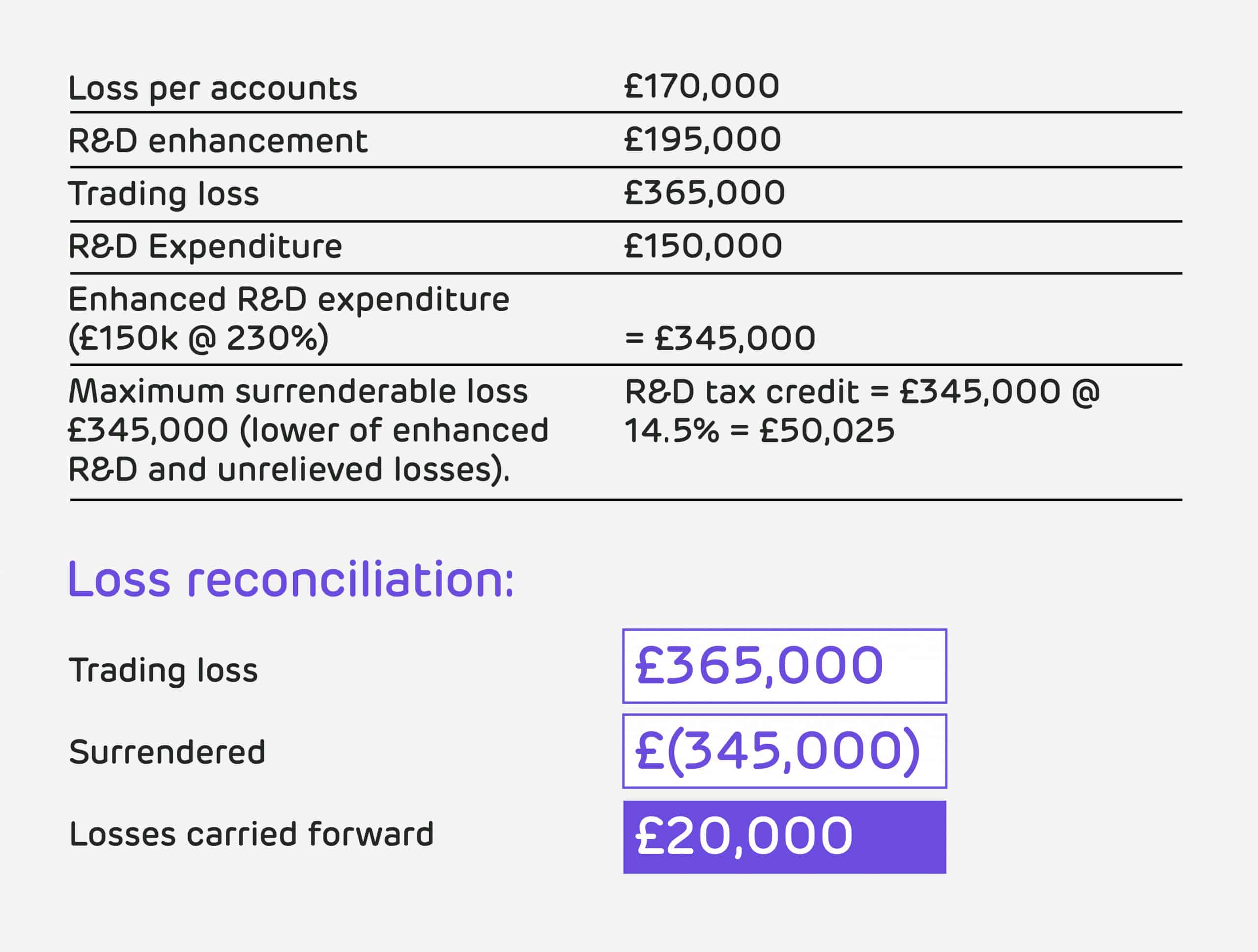

Supports Profit and Loss making companies. Tools to help you run your payroll. First LeedSegals needs to calculate their enhanced expenditure figure.

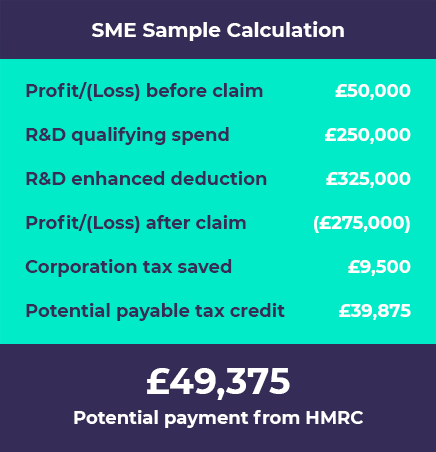

In general profitable SMEs can benefit from average savings of 25 so if a company. Estimate RD tax relief for your business. To calculate your expenditure you need to.

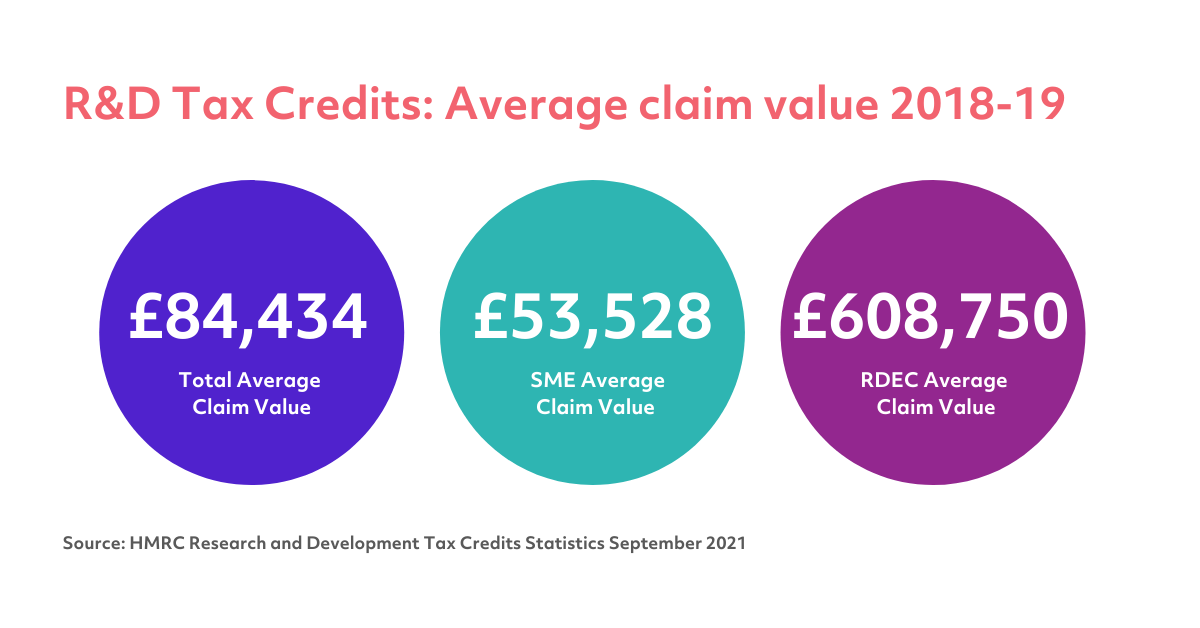

The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. RD tax credit calculation for profit making SMEs. According to the latest research and development RD Tax Credits Statistics Report 2018-2019 the average SME.

Calculate RD tax relief in under 3 minutes. How are RD tax credits calculated. The average RD tax credit.

Most RD tax credit calculations or worked examples that youll see online start by establishing which schemes apply. The net cash benefit after tax is 11. SMEs can claim up to 33p for every 1 spent on qualifying RD activities.

LeedSegals have recently spent 100000 on software development. The cash flow of the RD company in question is the primary consideration in this regard. This is because there are no profits to tax.

All companies can deduct 100 of eligible RD. Our RD tax credits calculator only gives a rough estimate of the potential corporation tax saving or RD tax credit payable that you may be eligible to claim. We really didnt realise how much of what we did qualifies under the RD Guidelines until we had it explained to us.

75000 x 130 97500 enhancement 200000 97500. Look below at some of the sectors this applies to and get an understanding of how for a few hours of your time you could earn thousands back from HMRC. 12 from 1 January.

The tax benefit can be utilised to reduce your corporation tax bill. The process was not. RDEC claims are paid as a taxable credit which equates to 13 of your eligible RD costs.

Sometimes this is a simple matter of working out whether. Work out the costs that were directly attributable to RD. RD tax credit calculation examples.

As a loss-making company they will have corporation tax of 0. Get a detailed RD calculations to your.

R D Tax Credits Calculation Examples G2 Innovation

R D Tax Credits Does Your Business Qualify For R D Tax Credits

R D Tax Credit Calculator Easy R D Claims Seedlegals

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

R D Tax Credits The Essential Guide 2020

Best Practices For Tracking R D Tax Credit Data During Eligible Projects

.png)

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

R D Tax Credits The Essential Guide 2020

R D Tax Claims Research And Development Tax Credit

Research Development Tax Credits Guide Ebs European Business Solutions

How To Calculate R D Tax Credits With Examples Kene Partners

R D Tax Accountants Research And Development R D Tax Credits Claim For Small Businesses Dragon Argent

R D Tax Credit Calculation Examples Mpa

R D Advance Funding Early Access To Your R D Tax Credit Mpa

Three Reasons To Stop Ignoring R D Tax Credits Mpa

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation How Much Will You Get Back